Anglo American invests $24M in Canada Nickel’s Crawford project in Ontario

Anglo American (LSE: AAL) is buying a minority stake in Canada Nickel (TSXV: CNC; OTCQX: CNIKF) to advance its Crawford project in northern Ontario with improved processing as battery metals continue to spark investments.

The London-based major is spending $24 million for a 9.9% share of Canada Nickel, whose main asset is the Crawford project near Timmins, the companies said in news releases on Wednesday. Anglo gets rights to buy 10% of the proposed mine’s nickel concentrate, iron and chromium as well as carbon credits from the project. It will also transfer technology for greater recoveries and less environmental impact.

Echelon Capital Markets called the investment a major endorsement of Canada Nickel’s management, the project and its stance on environmental, social and governance issues (ESG).

“The off-take agreement would also include any associated carbon credits, demonstrating the importance of ESG considerations in Anglo’s investment criteria and Canada Nickel’s leadership in such regards, an important part of our original investment thesis,” mining analyst Ryan Walker wrote in a note on Wednesday.

“Importantly, the proposed off-take agreement includes sales at market terms,” Walker said, without surrendering the benefit to Canada Nickel when metal prices rise.

Maintaining revenue like that may be a concern while Canada Nickel, having filed a preliminary economic assessment (PEA) on Crawford in 2021, still has years of development before entering production and won’t want to give away too much too soon.

The Anglo deal can be compared to how Giga Metals (TSXV: GIGA) last August sold 15% of its Turnagain nickel-cobalt project in British Columbia to Mitsubishi Corp. for $8 million. The company is expecting to release a prefeasibility study for the project mid-year.

Bulk tonnage

“Ours is the first investment by one of the major mining companies in a bulk tonnage nickel deposit in Canada,” Mark Selby, chairman and CEO of Canada Nickel, said in an emailed reply to questions. “Investment at the equity level allows us to retain 100% of the project.” Selby also noted Canada Nickel’s land has potential for several Crawfords.

The company is preparing a feasibility study for release by the end of June. It is targeting approvals, permits and licences to be completed by mid-2025 before construction. Total production is forecast at 842,000 tonnes of nickel over a 25-year mine life.

The Crawford PEA envisions spending US$1.2 billion for a mine processing 42,500 tonnes a day. Ramping up to 85,000 tonnes per day by year four would cost US$543 million and increasing to 120,000 tonnes a day would require US$194 million more, according to the PEA. Over its life, the mine would have sustaining capital costs of US$1 billion and average operating costs of US$11.27 per tonne.

Anglo’s investment is part of the company’s strategy to expand its battery-grade nickel output in addition to production from mines in South Africa and Brazil, Peter Whitcutt, chief executive officer of Anglo American’s marketing business, said in the release.

“We are committed to supporting our industry in increasing the availability of critical materials that will underpin the success of the energy transition, and to do so sustainably,” Whitcutt said. “Our in-depth product knowledge and portfolio of innovative technologies have the potential to provide a value-enhancing contribution to the development of the Crawford project.”

Cost cutting

Under the new agreement, Anglo aims to show Canada Nickel how to improve the targeting of minerals to reduce water, energy and capital by more than 30%, use data in predictive intelligence to reduce the variability in mining and enhance engineering controls to modernize the project.

Cantor Fitzgerald mining analyst Matthew O’Keefe said Anglo’s investment reduces development and financing risk. He raised his target price on Canada Nickel shares to $4.80 from $3.80.

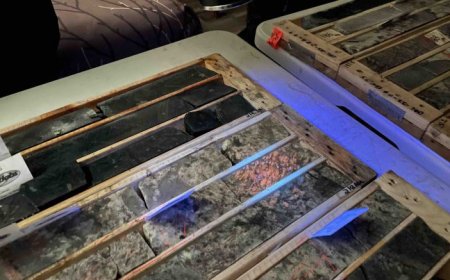

The project has measured and indicated resources of 1.4 billion tonnes grading 0.24% nickel and another 670 million inferred tonnes averaging 0.23% nickel, according to an update last year.

Last month, Canada Nickel outlined plans to use carbon capture and storage at Crawford, which may qualify for tax credits of up to 60% of some costs by 2030. It also said its Reid property 16 km southwest of Crawford could be even larger.

Shares in Canada Nickel rose 5% in Toronto on the announcement then lost most of the gain after the company said later that day it was issuing 9.2 million shares to raise $18.2 million. They closed on Thursday at $1.78 each, within a 52-week trading range of $1.18 and $4.01, valuing the company at $203 million.