Energy Fuels rides uranium price wave to production at southwest US mines

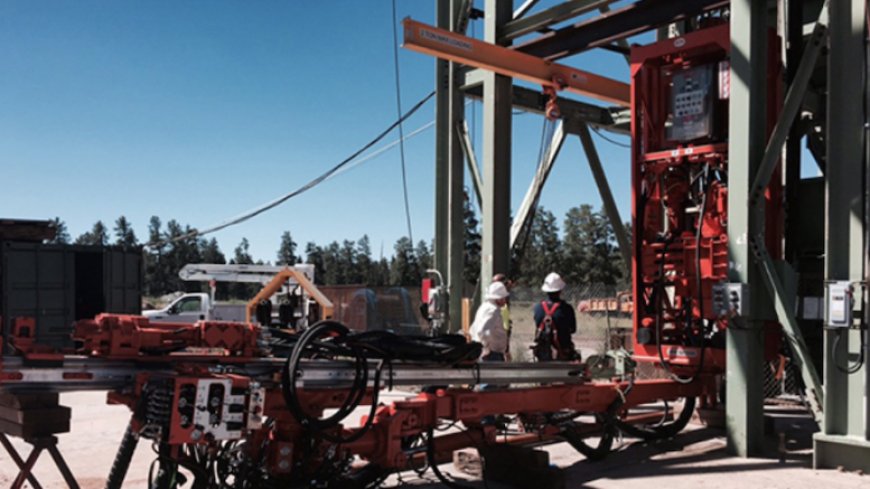

As uranium spot prices continued rising to new highs on Friday, Energy Fuels has started uranium production at its mines in Utah and Arizona.

As uranium spot prices continued rising to new highs on Friday, Energy Fuels (TSX: EFR; NYSE: UUUU) has started uranium production at its mines in Utah and Arizona.

EFR expects the uranium run rate to reach 1.1 to 1.4 million lb. per year after production ramps up towards the middle or end of next year at the La Sal and Pandora mines in Utah, and at the Pinyon Plain project in Arizona, Energy Fuels said in a news release on Thursday. Ore mined from the projects will be stockpiled at Energy Fuels’ White Mesa mill in eastern Utah for processing in 2025.

“Due to the substantial increase in uranium prices, U.S. government support for nuclear energy and nuclear fuel, and a global focus on reducing carbon-emissions, Energy Fuels is resuming large-scale uranium production,” company president and CEO Mark Chalmers said in a news release. “Uranium spot prices are (at) the highest level seen since 2007 when the uranium spot price reached a high of $135 per pound, or over $200 per pound on an inflation-adjusted basis.”

The Colorado-based company’s production start comes as spot prices of the energy metal increased to US$86.35 per lb. against a background of rising demand for uranium as more countries seek it out to replace fossil fuel energy sources, and U.S.-Russia uranium trade tensions.

Meanwhile Kazakhstan, the world’s leading uranium producer, this week reported its highest sales of the metal since 2015, driven mostly by rising demand in China as it rivals France for the second-most reactors in operation. The value of uranium sales abroad for the first 10 months of the year expanded by a third to US$2.46 billion compared to the same period last year.

Red Cloud Securities mining analyst David Talbot said in a research note on Friday that the restart of the La Sal and Pandora mines, which had been under care and maintenance since 2019 will take some time and working capital to get moving. Milling will have to be deferred to when White Mesa can come back online in 2025, he added.

“Going this route will help ensure that, upon resumption, the mill is sufficiently fed to run at modest capacity and improved efficiency,” he said, noting the restart was driven by positive market and policy factors favourable to uranium in the U.S., where nuclear power generates 20% of electricity.

Critical mineral windfall

EFR’s Pinyon Plain mine in northern Arizona hosts proven and probable reserves of 134,500 tons grading 0.58% uranium oxide (U3O8) for 1.6 million lb. uranium, according to a December 2022 pre-feasibility study. The mine has a life of 28 months and ore will be mined using long-hole stoping.

Capital costs are estimated at US$9 million and operating costs at US$50.5 million. The project has an after-tax net present value (at 5% discount) of US$20.8 million and an internal rate of return of 12%.

The La Sal Complex in eastern Utah, which includes the Pandora, Energy Queen, Redd Block and Beaver properties hosts 1 million measured tons of uranium grading 0.18% U3O8 for 3.7 million lb. U3O8, according to a December 2020 resource report. Its indicated resource totals 132,000 tons at 0.14% U3O8 for 367,000 lb. of U3O8; and it has 185,000 inferred tons at 0.10% U3O8 for 362,000 lb. U3O8.

In terms of vanadium, La Sal hosts 1 million measured tons grading 0.97% vanadium oxide (V2O5) for 19.5 million lb. V2O5; 132,000 indicated tons at 0.73% V2O5 for 1.9 million lb V2O5.; and 185,000 inferred tons grading 0.51% V2O5 for 1.9 million pounds.

Energy Fuels also said it’s preparing its Whirlwind uranium site in Arizona and Nichols Ranch in-situ recovery project in Wyoming for production within one year. The start of those operations would increase the company’s output to more than 2 million lb. of U3O8 per year starting in 2025, assuming strong market conditions persist.

In the first quarter of next year, EFR expects to sell 200,000 lb. of uranium into its portfolio of long-term contracts, with an unnamed utility customer having the option to buy an additional 100,000 lb. of uranium.

The company expects to start an ore buying program from third-party miners next year, another potential source of an expanded uranium production profile.

For its other nuclear metal projects of Roca Honda, Sheep Mountain and Bullfrog in New Mexico, Wyoming and New Mexico, respectively, EFR plans to advance permitting and development, which could increase production to up to 5 million lb. of U3O8 per year.

Adding to Energy Fuels’ critical minerals lineup, it’s also looking to advance its rare earths program at the White Mesa mill next year by producing neodymium-praseodymium (NdPr) oxide. The mill is currently installing capacity to produce up to 1,000 tonnes of the highly-sought rare earths often used for permanent magnet materials.

That output would be enough to power up to 1 million electric vehicles per year, Energy Fuels says. The capacity is expected to be finished in the first quarter of 2024 and EFR would be able to produce 60 to 80 tonnes of NdPr oxide next year. The company started working in the rare earths space in 2020.

The news about that capacity installation comes a day after China banned the export of technology used for extracting and separating rare earths, as Western countries continue working to create critical mineral supply chains separate from China’s influence. Energy Fuels’ shares traded at $10.16 apiece on Friday in Toronto, valuing the company at $1.6 billion. Its shares traded in a 52-week range of $6.70 and $12.17.