Piedmont earns 22.5% stake in Atlantic Lithium’s Ghana project

Piedmont Lithium (NASDAQ: PLL; ASX: PLL) has exercised its option to acquire an initial 22.5% stake in Atlantic Lithium’s (AIM: ALL, ASX: A11) Ewoyaa project in Ghana, having committed US$17 million to fund the project through its definitive feasibility study.

This completes the second stage of the investment agreement between the companies signed in 2021. Under the deal, Piedmont can earn a 50% equity interest in Atlantic’s Ghanaian lithium portfolio, headlined by the Ewoyaa project. The first stage involved a US$15-million investment into Atlantic, previously IronRidge Resources.

Piedmont said it will provide a further US$70 million toward Ewoyaa development in the third and final stage to acquire an additional 27.5% interest in the project. The remaining development costs will be shared equally with Atlantic, for a total commitment by Piedmont of approximately US$128 million.

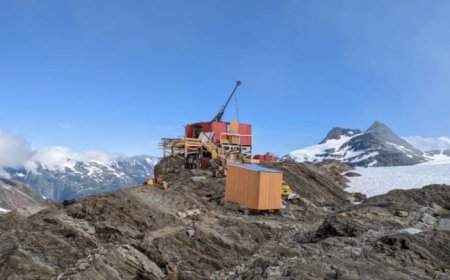

A feasibility study published in June projected Ewoyaa’s total capital cost at US$185 million. Once completed, it would be Ghana’s first lithium mine operation, producing 3.6 million tonnes of spodumene concentrate over a 12-year life. First production is targeted for 2025.

The study also showed that Ewoyaa has a post-tax net present value (at 8% discount) of US$1.5 billion, with free cash flow of US$2.4 billion from life of mine revenues of US$6.6 billion and an internal rate of return of 105%. This would give the project a payback period of 19 months.

Piedmont CEO Keith Phillips said the funding to support Ewoyaa furthers the company’s strategy to supply crucial lithium resources to U.S. electric vehicle and battery manufacturers. “We are pleased with the results of the Ewoyaa lithium project (definitive feasibility study) and our election to earn our initial 22.5% interest in Atlantic Lithium’s Ghanaian lithium project portfolio,” he said in a news release.

“Since our initial agreement in July 2021, Piedmont Lithium remained a highly supportive and collaborative partner, working alongside the company to achieve our shared goal of delivering a successful spodumene concentrate mine at Ewoyaa,” Neil Herbert, executive chairman of Atlantic Lithium, said.

The additional funding by Piedmont will be contingent on government and regulatory approvals for the project. Piedmont said it expects to be able to fund its contributions toward project development through the sale of lithium concentrate from its offtake agreement with North American Lithium (NAL).

The company is also entitled to purchase 50% of lithium concentrate production at Ewoyaa on a market-based pricing mechanism for the life of the mine. This offtake is being planned as feedstock for the Company’s proposed, 30,000-tonne-per-year lithium hydroxide conversion facility in Tennessee.

Earlier this month, Atlantic told Reuters that it is confident of getting a lease for the Ewoyaa mine following the approval of a green minerals policy by the country’s government.

Atlantic Lithium shares ended the trading day in London up 4%.